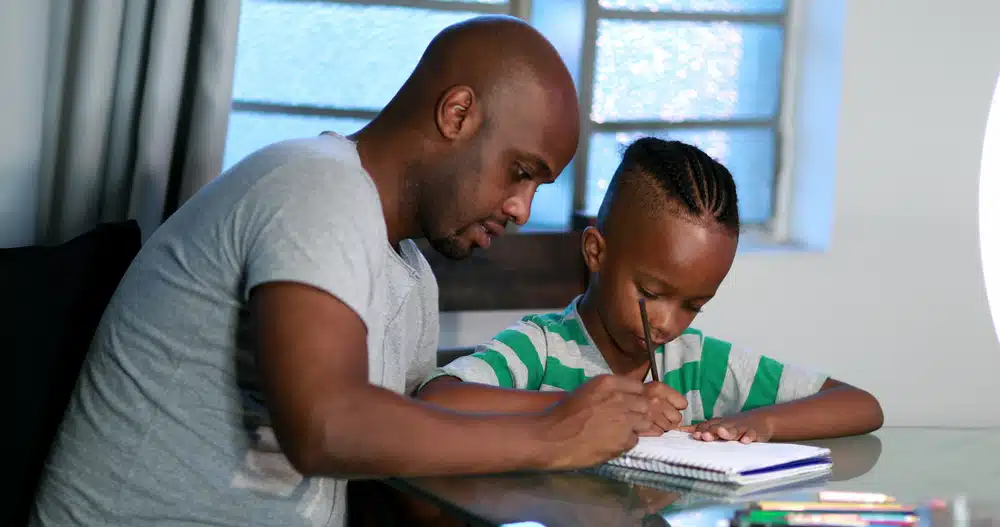

The transfer of generational skills from fathers to their sons through apprenticeship and communication plays a significant role in the success of family businesses and tribal enterprises.

This traditional approach involves fathers eagerly teaching their sons the ins and outs of the family business, work ethic, and specialized skills.

It results in the accumulation of “family secrets” — a treasure trove of knowledge about work, life, and productivity.

In this article, we will explore the importance of passing down generational skills, highlighting how it preserves valuable knowledge, strengthens family ties, promotes adaptability, and enhances skill development. We will also provide relevant statistics to emphasize the power of these practices.

1. Preserving Valuable Knowledge:

The transfer of generational skills ensures the preservation of valuable knowledge and “family secrets.” According to a study by PricewaterhouseCoopers, 70% of family businesses consider the transfer of knowledge and skills from one generation to the next as crucial for their long-term success.

These “family secrets” go beyond what can be learned in textbooks, encompassing practical expertise, insights, and strategies that have been refined over time.

2. Strengthening Family Bonds:

Passing down generational skills through apprenticeship and communication strengthens the bonds within families. The mentorship provided by fathers creates a unique connection between generations, fostering a sense of togetherness and shared purpose.

Research from the Family Business Institute shows that effective knowledge transfer practices in family businesses contribute to family unity and harmony, resulting in improved business performance and longevity.

3. Promoting Adaptability:

Generational skills passed down through apprenticeship and communication promote adaptability in family businesses and tribal enterprises. Sons learn not only the established practices of the trade but also the importance of embracing change.

This adaptability allows businesses to respond to evolving market conditions and technological advancements. A study published in the Journal of Small Business Management found that family businesses with successful knowledge transfer practices are more likely to innovate and experience higher revenue growth and profitability.

4. Enhancing Skill Development:

Apprenticeship and communication of generational skills lead to enhanced skill development. Sons learn from their fathers through hands-on experience, gaining practical mastery and a deep understanding of the trade.

According to a survey by KPMG, 85% of family businesses believe that their multi-generational knowledge transfer practices contribute to operational efficiency and competitiveness. This practical expertise enables businesses to excel in their respective fields, delivering high-quality products or services and maintaining a competitive edge.

Reasons to Start a Family Business or Tribal Enterprise: Building Generational Corporate Growth

1. Legacy and Generational Wealth

Creating a family business or tribal enterprise allows you to establish a lasting legacy for future generations. Just as strategic growth shaped businesses during the industrial age, starting your own venture enables you to build generational wealth and provide opportunities for your family’s future prosperity.

2. Stronger Family Bonds and Unity

Embarking on the journey of a family business fosters stronger bonds and unity among family members. Working towards a common goal and shared vision promotes collaboration, teamwork, and a sense of togetherness that extends beyond business activities.

3. Control and Autonomy

Starting a family business grants you greater control and autonomy over your professional journey. You have the freedom to shape the direction of the business and make decisions aligned with your family’s values and long-term vision, allowing for a more fulfilling and purpose-driven entrepreneurial experience.

4. Adaptability and Agility

Family businesses and tribal enterprises possess inherent adaptability and agility, which are advantageous in navigating a dynamic business landscape. Starting your own venture enables you to quickly respond to market changes, seize emerging opportunities, and stay ahead of the curve in a rapidly evolving world.

5. Social and Economic Impact

By starting a family business or tribal enterprise, you have the potential to make a significant social and economic impact. Your venture can create job opportunities, contribute to local economies, and become a source of pride for your community. It allows you to align your business goals with the betterment of society, leaving a positive and lasting mark.

As we stand on the cusp of a new era, with access to vast knowledge and technological advancements, there is no better time to channel your family’s energy into generational corporate growth. By starting a family business or tribal enterprise, you embark on a journey that not only honors the past but also propels your family towards a future filled with opportunity, prosperity, and a lasting legacy.

Conclusion:

Passing down generational skills through apprenticeship and communication brings numerous benefits to family businesses and tribal enterprises. It preserves valuable knowledge, strengthens family bonds, promotes adaptability, and enhances skill development.

The statistics mentioned above emphasize the significance of these practices in driving the success and longevity of such businesses. By embracing the power of generational skills, businesses and enterprises can tap into a wealth of accumulated wisdom and experience, ensuring their continued growth and prosperity.